top of page

Digital Account Opening

Lead Product Designer

Critical Thinking

INTRODUCTION

Overview

This project aimed to empower smaller financial institutions with a streamlined way to onboard new members digitally. By designing a flexible, user-first application flow, I created a system that mirrors the in-branch experience while allowing customers to open accounts online. The goal: reduce friction, increase sign-ups, and modernize the onboarding journey.

PAIN POINTS

The Problem

Most smaller financial institutions relied solely on in-person processes to open new accounts. This limited growth to whoever could physically walk into a branch. Without digital onboarding, they struggled to attract new members and compete with larger banks offering seamless online options.

DEFING DONE

Opportunity

By digitizing the account-opening process, institutions could attract more customers without relying on branch visits. The solution was to create a self-service application flow that mirrored the in-branch process but offered the flexibility and speed of online access. This design gave FIs a way to scale while still maintaining compliance and trust.

PRELIMINARY RESEARCH

Understand the Problem

Before jumping into design, I needed to understand what was working well in online banking and where users felt frustrated. I reviewed existing industry data and conducted a focused usability test with people who had recently opened accounts online. They shared what they liked—such as quick steps, progress trackers, and clear error messages—as well as what they disliked, including unclear guidance and losing progress mid-application. These insights gave me a foundation to design a flow that blended speed, clarity, and reassurance.

CREATING PERSONAS

Getting to Know Our Users

Based on our research, we developed a persona to keep our design process grounded. Having a clear picture of our user helped us focus on their needs, frustrations, and goals throughout the experience.

James Bradshaw

AGE

Small Business Owner (Restaurant: Fork & Cork)

36

LOCATION

Atlanta, GA

“If I can’t do it in between the lunch and dinner rush, I probably won’t get it done at all.”

Bio 🧬

James runs a growing restaurant with his wife, handling both operations and finances while she manages the front-of-house experience. As a busy entrepreneur, his schedule leaves little room for administrative tasks like visiting a bank branch in person.

Frustrations 😤

Limited time to step away from his business for errands

Paper-heavy processes that feel slow and outdated

Having to repeat information multiple times across different forms

Personality 🧠

Goals 🎯

Open a business checking account without leaving his restaurant

Access modern banking tools to manage cash flow more efficiently

Keep his financial tasks as streamlined as possible so he can focus on growth

HAPPY PATH

User Flow

The user flow illustrates the “happy path” for opening a business checking account online. Starting with product selection, applicants move step by step through providing personal details, business information, and ownership data before reviewing disclosures. The flow is intentionally streamlined to surface only the need-to-know information at each step, reducing friction while ensuring compliance. The goal is to help users complete the task in just a few clicks, creating a clear and consistent experience that works for both applicants and admin users.

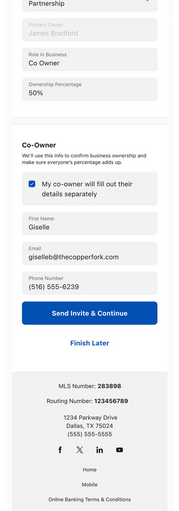

SCREENS

Deliverables

The final deliverables included a set of polished mobile screens that show the end-to-end experience from the user’s perspective. These designs visualize the full application process—from product selection through account decisioning—emphasizing clarity, efficiency, and trust. While time didn’t allow for wireframes, the fidelity of these screens ensured stakeholders could clearly see how the experience would function for real members.

COMPLIANCE RREADY

Utilizing AI

AI-driven Know Your Customer (KYC) transforms onboarding by automating ID verification. Applicants scan a government-issued ID—driver’s license, passport, or social security card—and the system detects the document type, extracts information, and validates it against compliance databases in real time. This reduces fraud, speeds up approvals, and eliminates repetitive checks for FI staff. It also creates a consistent audit trail for regulators while giving applicants a seamless mobile-first experience. For financial institutions, the payoff is clear: greater efficiency, higher conversion, and stronger adoption from digital-first users who expect banking to be instant and accessible.

CONSIDERING BOTH SIDES OF THE EXPERIENCE

Designing for Admin Users

While the mobile flow focused on enabling users to open a digital account quickly and intuitively, it was equally important to consider the experience on the receiving end. Admin users are responsible for reviewing, processing, and validating applications, which requires a desktop interface that balances efficiency with clarity. Designing for both perspectives ensures that information is surfaced in the right way—simple for the applicant, but structured and actionable for the admin. By building with both sides in mind, the experience remains seamless across the full lifecycle of the application.

CONCLUSION

Outcomes In Action

This project delivered a clear, guided digital onboarding flow that streamlined how users opened accounts while also supporting FI staff with mirrored views. By digitizing the account opening process, FIs unlocked new growth opportunities and improved their member experience.

Problem 🧩

Small FIs relied solely on in-branch account opening, limiting growth and convenience for busy members.

Solution 🔧

A digital onboarding flow that mirrored both self-service and in-branch experiences.

Impact 🚀

FIs onboarded more members digitally, increasing platform adoption by 27% in the first year and creating new revenue growth for both the institution and Alkami.

ROLE BREAKDOWN

Contributions

Although this was a team initiative, my specific contributions drove the project forward from start to finish. I translated business requirements into actionable design tasks, led the creation of detailed personas, and mapped both member and admin user journeys to ensure parity across experiences. I designed high-fidelity screens for desktop and mobile, building an interactive prototype that allowed stakeholders to visualize the full flow and stress-test edge cases. I also validated these designs through internal reviews and iteration, ensuring the final solution balanced compliance requirements with a seamless applicant experience.

Conducted Research

Ran a usability study to uncover what users liked and disliked about current digital account opening flows.

Curated Personas

Created a focused persona to anchor design decisions and prioritize the needs of busy small business owners.

Designed End-to-End Screens

Delivered the full applicant journey, ensuring the flow was intuitive, efficient, and visually consistent.

Prototyped & Validatated

Built clickable prototypes to test flow logic and validate with stakeholders before handoff.

FINAL THOUGHNTS

Reflection

We were able to deliver a holistic solution that worked for both applicants and admin users. By keeping the flows consistent across mobile and branch, applicants could self-serve online or walk into a branch and still experience the same streamlined journey. This gave smaller financial institutions confidence that they could compete with larger banks offering digital onboarding without sacrificing consistency.

The process wasn’t without challenges. One of the biggest snags was deciding when and how to surface disclosures. Admin users wanted them earlier in the flow, while we knew placing them too soon would create unnecessary friction for applicants. It took several iterations to land on an approach that respected compliance requirements while keeping the happy path intact.

Another fork in the road came when we debated whether to create two separate flows—one for branch and one for online. Some stakeholders pushed for a lighter in-branch flow, assuming staff could fill in gaps verbally. But that risked inconsistencies and extra training overhead. I advocated for a one-to-one match, and ultimately, it proved to be the stronger solution. It simplified things for staff, reassured applicants, and reduced the chance of errors.

In the end, this solution worked holistically because it expanded the FI’s reach. Instead of only capturing leads from people willing to walk into a branch, they could now onboard members fully online while still offering the traditional in-branch option. That hybrid model positioned them to attract younger, tech-savvy users without alienating existing members—and gave credit unions a way to future-proof their growth.

Curious About The Work?

If you have questions, thoughts, or feedback — or just want to talk shop — feel free to reach out. I’d love to hear from you.

You can fill out the contact form here, and I’ll get back to you as soon as I can.

bottom of page